Rystad Energy Oil Production Cost

According to a new study from Rystad Energy the United Kingdom led the world in cutting the cost of its offshore oil and gas production. Total production with an SRM cost above 15 per barrel is around 4 million bpd.

Rystad Average Well Production Curves And Proppant Use Per Lateral Length Oklahoma Oct 2015

Tight oil such as onshore shale oil in the US has witnessed an impressive turnaround over the last few years.

Rystad energy oil production cost

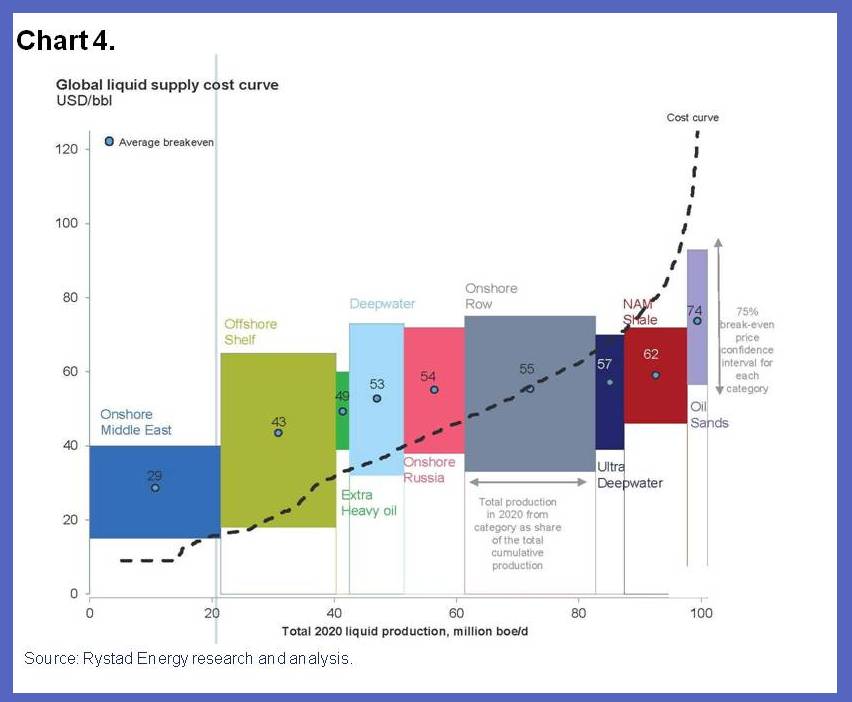

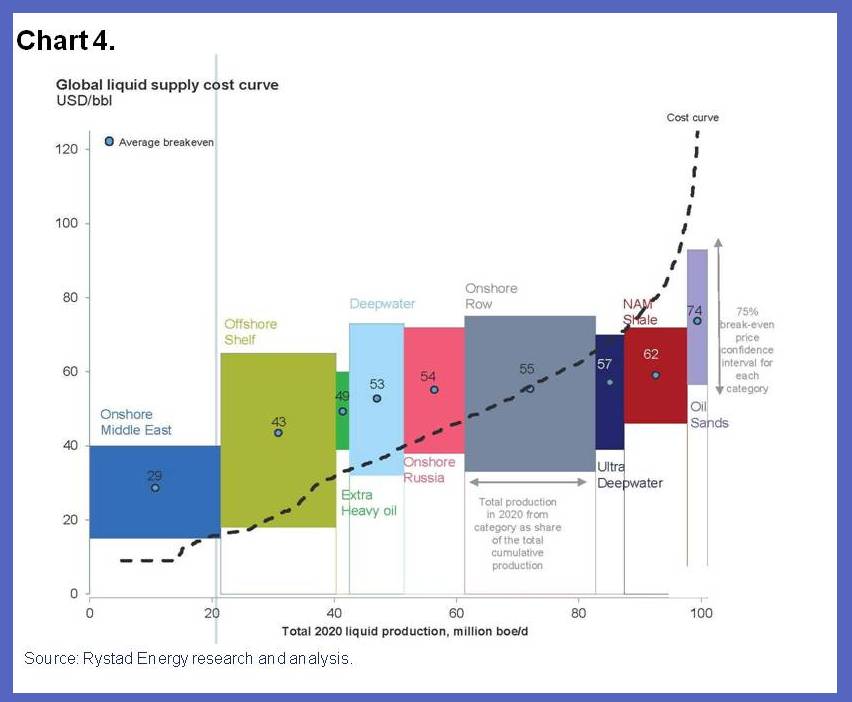

. The equilibrium price moves from around 25 per barrel no additional OPEC supply to 19 per barrel in. Our weekly monthly and quarterly Analytics will help to analyze the global demand and supply picture understand the. Based on our fundamental databases it synthesizes the market implications and our expert short to long-term view through reports and commentaries. However given the currently prevailing low oil price environment the development of these fields has been postponed by more than a year until the price environment improves.Operational production costs in the oil and gas industry have fallen across the globe with the United Kingdom emerging as a cost-cutting powerhouse among global offshore regions. Operational production costs down globally led by UK. Operational production costs in the oil and gas industry have fallen across the globe with UK emerging as a cost. Rystad Energy said Brazils lifting cost is now estimated approximately at 1470 seeing savings of 230 per barrel compared to its pre-downturn estimate.

In 2018 Rystad estimated an average breakeven price of 47 per barrel and a potential supply of 22 million bpd. In fact the majority of currently unsanctioned top discoveries have breakeven. These fields are estimated to have a breakeven oil price below 50 per barrel and were earlier expected to be sanctioned for development in 2020-2021. The world has changed for oil producers.

Based on reported power outages and the closure of refineries in preparation for the storm nearly 2 million bpd of US Gulf Coast. Rystad Energys initial assessment of Hurricane Idas impact on US oil production and refinery capacity estimates a peak daily supply curtailment of 18 million barrels per day in the Gulf of Mexico which currently has a peak daily production capacity of 19 million bpd. Mexicos savings are calculated at 180 bringing lifting costs down to 890 per barrel. The cost of supply curve moves to the right if OPEC increases production.

Get instant access to key project costs and characteristics as well as company service market and regional analyses in an easy-to-digest format. Rystad Energys initial assessment of Hurricane Idas impact on US oil production and refinery capacity estimates a peak daily supply curtailment of 18 million bpd in the Gulf of Mexico which currently has a peak daily production capacity of 19 million bpd. Based on reported power outages and the closure of refineries in preparation for the storm nearly 2 million bpd of US. With oil trading above 70 per barrel while investment activity remains low the worlds publicly traded exploration and production EP companies are set to generate.

The results are clear from 2014 to 2018 the UK reduced operational production costs. A comprehensive Rystad Energy analysis of oil production costs has revealed that the average breakeven price for all unsanctioned projects has dropped to around 50 per barrel down around 10 over the last two years and 35 since 2014. After 2018 the breakeven price for tight oil has continued to fall reaching a current average of 44 per barrel. For example between 2014 and 2018 the.

Rystad Energy estimates that the total demand for liquids will be around 100 million bpd in June 2020 assuming no coronavirus impact. Oil Market Analytics is a global oil market research service delivering the synthesis of our comprehensive fundamentals data for oil. A comprehensive Rystad Energy analysis of oil production costs has revealed that the average breakeven price for all unsanctioned projects has dropped to around 50 per barrel. In 2015 North American shale ranked as the second most expensive resource according to Rystad Energys global liquids cost curve with an average breakeven price of 68 per barrel.

However the potential of tight oil production has dropped from Rystads 2018 estimate. When crude-oil prices were more than 100 a barrel just two years ago the ensuing profits were huge filling government coffers and swelling company earnings. A Rystad Energy analysis aimed at mitigating currency effects confirms this trend after examining regional opex reduction per barrel measured in local currency. Average cash cost to produce a barrel of oil or gas equivalent in 2016 based on data from March 2016.

Get a timely and comprehensive overview of project cost and service price trends across the energy supply chain powered by Rystad Energys databases. A comprehensive Rystad Energy analysis of oil production costs has revealed that the average breakeven price for all unsanctioned projects has dropped to around 50 per barrel. A comprehensive Rystad Energy analysis of oil production costs has revealed that the average breakeven price for all unsanctioned projects has dropped to around 50 per barrel down around 10 over the last two years and 35 since 2014.

The Current Fracklog Will Not Save Us Shale Production At A 30 Usd Bbl Wti

North American Shale Production Split By Brent Equivalent Breakeven Oil Prices Through 2015 Rystad Energy Shale Expectations North American

Permian Tight Light Oil Cost Curve 2015 Rystad Energy

Offshore Still Cheaper Than Shale Oil Sands Is Struggling

Average Brent Equivalent Breakeven Price Rystad Energy Unknown Year Gas Prices Oils Price

Permian Becoming Largest Us Tight Oil Play Oil And Gas Oils Basin

Why Cratering Oil May Not Crush Shale Producers Oils Shale Oil And Gas

Oil Production Break Even Costs Vs Their Share Of Future Total Productions In Millions Of Barrels Per Day Chart Big Picture Oils

With oil trading above 70 per barrel while investment activity remains low the worlds publicly traded exploration and production EP companies are set to generate. Rystad Energys initial assessment of Hurricane Idas impact on US oil production and refinery capacity estimates a peak daily supply curtailment of 18 million barrels per day in the Gulf of Mexico which currently has a peak daily production capacity of 19 million bpd.

Permian Becoming Largest Us Tight Oil Play Oil And Gas Oils Basin

Rystad Energys initial assessment of Hurricane Idas impact on US oil production and refinery capacity estimates a peak daily supply curtailment of 18 million bpd in the Gulf of Mexico which currently has a peak daily production capacity of 19 million bpd.

Rystad energy oil production cost

. A comprehensive Rystad Energy analysis of oil production costs has revealed that the average breakeven price for all unsanctioned projects has dropped to around 50 per barrel down around 10 over the last two years and 35 since 2014. However given the currently prevailing low oil price environment the development of these fields has been postponed by more than a year until the price environment improves. A comprehensive Rystad Energy analysis of oil production costs has revealed that the average breakeven price for all unsanctioned projects has dropped to around 50 per barrel. These fields are estimated to have a breakeven oil price below 50 per barrel and were earlier expected to be sanctioned for development in 2020-2021.Our weekly monthly and quarterly Analytics will help to analyze the global demand and supply picture understand the. For example between 2014 and 2018 the. However the potential of tight oil production has dropped from Rystads 2018 estimate. Mexicos savings are calculated at 180 bringing lifting costs down to 890 per barrel.

Oil Market Analytics is a global oil market research service delivering the synthesis of our comprehensive fundamentals data for oil. Operational production costs in the oil and gas industry have fallen across the globe with UK emerging as a cost. Rystad Energy estimates that the total demand for liquids will be around 100 million bpd in June 2020 assuming no coronavirus impact. In 2018 Rystad estimated an average breakeven price of 47 per barrel and a potential supply of 22 million bpd.

Based on reported power outages and the closure of refineries in preparation for the storm nearly 2 million bpd of US Gulf Coast. Get instant access to key project costs and characteristics as well as company service market and regional analyses in an easy-to-digest format. When crude-oil prices were more than 100 a barrel just two years ago the ensuing profits were huge filling government coffers and swelling company earnings. After 2018 the breakeven price for tight oil has continued to fall reaching a current average of 44 per barrel.

Rystad Energy said Brazils lifting cost is now estimated approximately at 1470 seeing savings of 230 per barrel compared to its pre-downturn estimate. Based on reported power outages and the closure of refineries in preparation for the storm nearly 2 million bpd of US. Operational production costs in the oil and gas industry have fallen across the globe with the United Kingdom emerging as a cost-cutting powerhouse among global offshore regions. The results are clear from 2014 to 2018 the UK reduced operational production costs.

In 2015 North American shale ranked as the second most expensive resource according to Rystad Energys global liquids cost curve with an average breakeven price of 68 per barrel. A comprehensive Rystad Energy analysis of oil production costs has revealed that the average breakeven price for all unsanctioned projects has dropped to around 50 per barrel down around 10 over the last two years and 35 since 2014. In fact the majority of currently unsanctioned top discoveries have breakeven. A Rystad Energy analysis aimed at mitigating currency effects confirms this trend after examining regional opex reduction per barrel measured in local currency.

Operational production costs down globally led by UK. Get a timely and comprehensive overview of project cost and service price trends across the energy supply chain powered by Rystad Energys databases. The equilibrium price moves from around 25 per barrel no additional OPEC supply to 19 per barrel in. A comprehensive Rystad Energy analysis of oil production costs has revealed that the average breakeven price for all unsanctioned projects has dropped to around 50 per barrel.

Average cash cost to produce a barrel of oil or gas equivalent in 2016 based on data from March 2016. Based on our fundamental databases it synthesizes the market implications and our expert short to long-term view through reports and commentaries. The cost of supply curve moves to the right if OPEC increases production. The world has changed for oil producers.

Offshore Still Cheaper Than Shale Oil Sands Is Struggling

Why Cratering Oil May Not Crush Shale Producers Oils Shale Oil And Gas

Average Brent Equivalent Breakeven Price Rystad Energy Unknown Year Gas Prices Oils Price

Oil Production Break Even Costs Vs Their Share Of Future Total Productions In Millions Of Barrels Per Day Chart Big Picture Oils

North American Shale Production Split By Brent Equivalent Breakeven Oil Prices Through 2015 Rystad Energy Shale Expectations North American

Rystad Average Well Production Curves And Proppant Use Per Lateral Length Oklahoma Oct 2015

The Current Fracklog Will Not Save Us Shale Production At A 30 Usd Bbl Wti